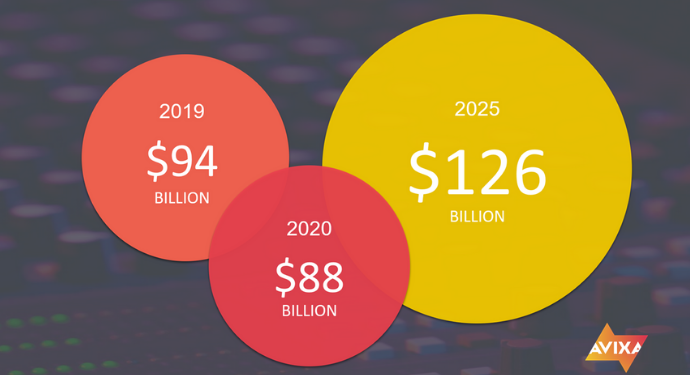

Asia-Pacific (APAC) pro AV revenues will decline from $94 billion in 2019 to $88 billion in 2020 due to the impact of COVID-19, but will outperform other major regions around the globe, according to the new 2020 AV Industry Outlook and Trends Analysis (IOTA) Asia-Pacific Summary produced by AVIXA, the Audiovisual and Integrated Experience Association. APAC is expected to return to strong growth in 2021, with revenue rising by 9.1%. Looking further into the future, APAC pro-AV revenue is forecast to reach $126 billion in 2025.

“Decisive approaches to the COVID-19 crisis by many countries in the APAC region have facilitated the continued economic expansion of the region. Overall, APAC has weathered the downturn better than other regions around the world, thus propelling renewed spending on pro AV products,” said Sean Wargo, Senior Director of Market Intelligence, AVIXA. “APAC’s level of pro-AV revenue growth will not only lead the world but also exceed GDP growth for the APAC region and globally.”

China leads the way in pro-AV revenue in APAC as well as globally with $55.3 billion in 2020. China also will boast a region-leading 8.3% CAGR from 2020-2025. The smaller Indian Subcontinent will generate $7.7 billion in revenue for pro-AV in 2020. The region’s economy and expanding corporate sector will spur a strong CAGR of 7.6% from 2020-2025. East Asia, a subregion that includes Japan and South Korea, will experience a moderate CAGR of 5.5% from 2020-2025. With $3.7 billion in revenue, Australasia represents just 5% of APAC regional revenue in 2020 and will generate the least growth among the APAC subregions, with a 4.2% CAGR expected for 2020-2025.

The corporate market is the largest application area for pro AV products and services, capturing $18.1 billion in 2020 and growing to $25.9 billion in 2025. With more companies expected to embrace remote working, they will be making investments in creating more huddle spaces for when employees are in the office. Additionally, there will be increased deployment of digital signage for communicating with employees and visitors about the necessary health guidelines in the short term. In the long term, these displays can become further gathering points for collaborative work.

Media and entertainment is the second largest vertical market, generating $13.3 billion in revenue in 2020, and a 15% share of APAC revenue. Revenue will rise to $20 billion in 2025, keeping this market in second place in the region. Within the media and entertainment vertical, headphones, headsets, and ear sets will generate the most growth of any product type, with a CAGR of 17.3% from 2020-2025. However, media storage and media servers offer a combination of size and growth that will fuel this industry’s pro-AV spending growth, with the two products generating CAGRs of 13.8% and 12.7% respectively from 2020-2025.

Security/surveillance/life safety will change from the fourth largest pro-AV solution in 2020 to the leading solution by 2025, growing from $10.9 billion $19.2 billion. The government and military industry will generate the most demand for this solution both in the short and long term. City surveillance is a significant market for security cameras, which requires significant storage and server systems to support the camera infrastructure.

Streaming media, storage, and distribution is the largest product segment in APAC, growing from $27.6 billion in 2020 and to $46.7 billion in 2025. Multiple factors are contributing to the streaming media, storage & distribution segment’s dominance across the APAC region, including TV content, 4K and 8K workflows, and IP infrastructure rollouts.

The IOTA report is produced by AVIXA in conjunction with Omdia (formerly IHS Markit), a global research firm with expertise across a number of underlying supply chain markets, many of which overlap with the principal components of the pro-AV industry. This specialization provides connections with manufacturers, distributors, integrators, and larger end-user firms that provide and consume pro AV products and solutions. This translates into sources of data that are modelled in conjunction with key macroeconomic data to generate the forecasts shown.

To learn more about the 2020 AV Industry Outlook and Trends Analysis (IOTA) APAC Summary, visit www.avixa.org/IOTA.