Audio consultancy and networking experts RH Consulting (RHC) have been counting networked audio products and licensees since 2013 to chart the adoption of audio networking in the pro audio, AV and broadcast markets. RHC have compiled the 11th edition of this report, universally recognised as the benchmark for tracking trends in networked audio, to provide insights into the current state of the industry.

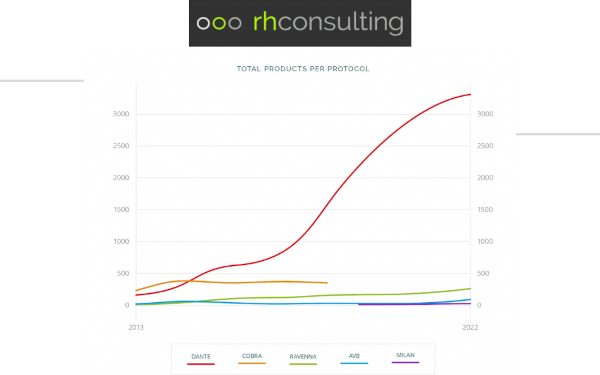

It covers all the major protocols including Dante, RAVENNA, AES67, AVB, Milan and others. Following the addition of video and control protocols in last year’s report, RHC have added IPMX and NDI and will further broaden the scope in the future.

The statistics show that the number of networked AV products on the market continues to grow, with the total number of products being shipped being charted at 5,219, from 552 different brands. This increase of over 1,000 from last year’s report seems to indicate that the industry is successfully rebounding from a rough spell of years caused by the pandemic. Dante once again cements its dominance in the Audio over IP (AoIP) sector, adding more products to the market than all other protocols combined and RAVENNA continue their steady progress in second place, as the protocol of choice in the broadcast industry.

“Video adoption over IP has been slower than audio due to bandwidth limitations allowing only a few video channels to pass, increasing bandwidth demands for improving video quality, and unsustainable single-manufacturer solutions,” comments Roland Hemming, from RHC, on the Video over IP data. “We observed that many of the products are simply video encoders/decoders, which reminds us of the early days of AoIP.”

“It’s reassuring to see that the number of products on the market continues to grow in the face of supply chain shortages,” states Hemming. “The Video networking market is still in its infancy when compared to AoIP, but now that we have collated two years of data, we can begin to draw a line. NDI are currently leading the charge in this category in terms of overall manufacture and distribution and are also making the most concerted effort to embed this technology inside their products. We’re excited to see how this develops in the future as technologies improve.”

For a full breakdown of all the statistics and a comprehensive listing of all the protocols considered and how the data is compiled, please visit: